So you want to buy a home – but the down payment seems like such a hurdle. You’re not alone. The idea of making a 10% or 20% down payment keeps a lot of people from pursuing their dream of owning a home. But it doesn’t have to.

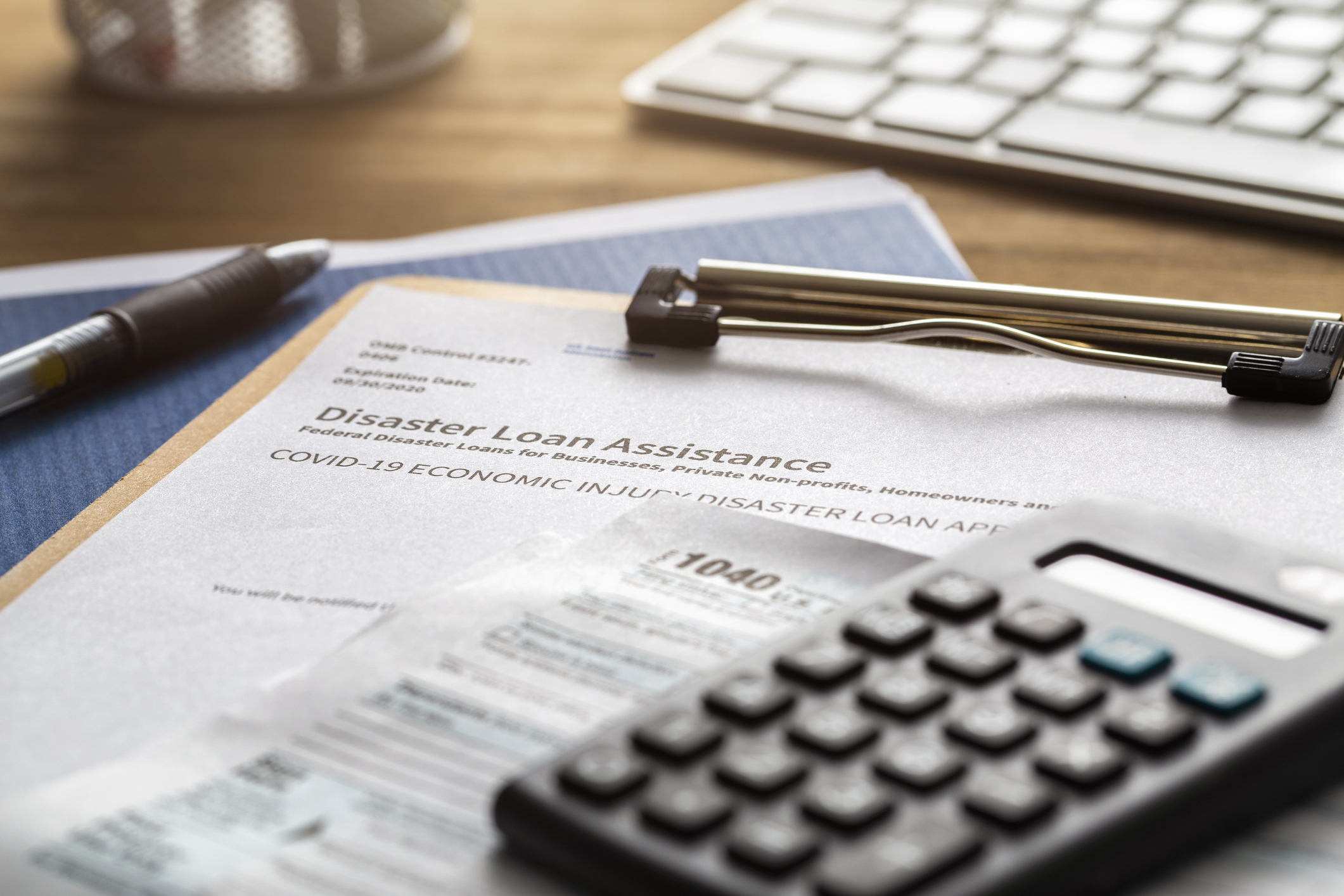

Look Into First-Time Home Buyer Programs

As a first-time home buyer, you may qualify for an FHA, VA, NIFA or USDA mortgage loan. These programs are designed to help you get into your home with either a very low down payment – or no down payment at all.

Ask Your Lender About Your Options

With good credit history and a strong employment record, you may qualify for a conventional mortgage with as little as 3% to 5% down. You’ll never know unless you ask.

Have a Target in Mind

Based on what you find out from your lender, set a goal – a specific dollar figure, like $5,000. This will actually make it easier to save and you’ll enjoy measuring your progress.

Put Together a Savings Plan

Even if you qualify for a special first-time home buyer program, you’re going to need savings. In addition to any down payment, you’ll need to cover closing costs and you’ll want to have at least three to six months living expenses in cash reserves.

- Cut your rent. Consider moving to a smaller apartment or getting a roommate. A dramatic change in your lifestyle can lead to big savings.

- Cut your credit card debt. If you have to use credit cards, try to pay off the entire balance each month to avoid interest charges.

- Cut your spending. Look for ways to cut your monthly living expenses and guard against mindless spending.

- Find a second income. Stashing away the paycheck from a part-time job is a great way to save.

- Automate savings contributions. Set up an automatic transfer into a money market or savings account.

- Redirect your retirement savings. Reduce deposits into your IRA or 401(k) and redirect the difference into saving for a home.

- Set aside refunds. The average federal income tax refund is over $3,000. Don’t spend it; set it aside.

- Be open to help from the family. A lot of first-time home buyers get a little help with the down payment from parents or grandparents.

Getting the facts about what you need to save, having a specific target in mind and putting a savings plan together – this is how you can overcome the mental and financial hurdle of the down payment and achieve your dream of owning a home.

First-Time Home Buyer’s Guide

If you’re thinking about buying your first home, a great place to start is with our First-Time Home Buyer’s Guide, which provides all sorts of advice, tools and tips for the home buying journey. It will give you a clear picture of what to expect all along the way. View or download the guide today for the information you need to make a sound financial decision.

Fili Sanchez (NMLS #528671) is the Vice President and Mortgage Relationship Manager for our Kearney, Riverdale, Burwell and Ord markets. He has been with Heartland Bank for 10 years and has 15 years of mortgage lending experience. He is also a recent graduate of the Advanced School of Banking. Fili enjoys participating in the community with the Kearney Area Chamber of Commerce, Leadership Kearney, Nebraska Banker's Association, and serves on the board for the Yanney Heritage Park Foundation. Outside of the bank, he enjoys spending time with his wife and three children, traveling to kids' sports activities and family vacations.