"Should I buy that new planter this year?" This question has come up several times while meeting with customers during this renewal season. It’s the age old question that most ag producers face. “Should I continue spending money on repairs and fixing up old equipment, or should I put money towards a newer model with the latest and greatest technology?”

Reasons to Buy a New Planter

In the last decade, planting has incorporated a wealth of new technology, with the masses now embracing precision planting to some extent. This means nearly all planters rolling through the countryside in this region are likely to be equipped with some form of precision planting equipment. This may be limited to just GPS guidance, allowing for straighter rows and more precise field mapping. It could also be as precise and scientific as placing each seed where prescribed in a detailed prescription formulated by your seedsman or agronomy professional.

If the technology is getting older or isn’t even in place on your current planter, you may be thinking now is the time for an upgrade. If you have simply deferred the maintenance on your current implement or have covered a large number of acres, it may also be the right time to replace it.

Reasons to Use Your Current Planter

As we discuss new planters or different equipment of any kind, we must keep in mind that corn is now worth $3.35 a bushel instead of $5.00 a bushel like it was in the not so distant past. The painful truth is that making these upgrades now may be much more difficult for operations to handle in their current cash flows.

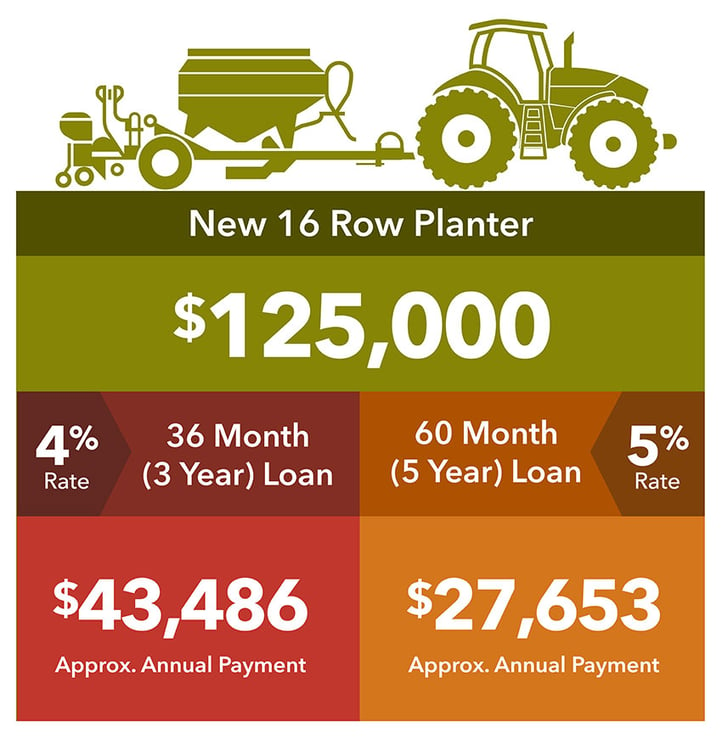

The typical equipment loan is a three year or five year amortized loan. A new 16 row planter will cost approximately $125,000 with most of the equipment on it needed to operate. Taking that amount on a three year note at 4% would equal a payment of $43,486 per year. The same amount on a five year note at 5% would equal a payment of $27,653 per year. Adding that amount of principal and interest to service into any operation’s cash flow can be difficult in these times. On the other hand, making $10,000 in repairs to an already aging planter can also quickly add up over time.

Determining Your Breakeven

It is in times like these that an operator really needs to look closely at their overall cost of production. They need to thoroughly understand breakeven points of their operation. Then they should include something like this newly considered purchase and see how it will affect their operation’s overall breakeven point.

In almost every renewal meeting that I have had this year, we have talked about some sort of a capital purchase like this with a customer. In these situations, we run the numbers and evaluate how such a purchase will affect the operation’s breakeven point. In some cases, we come to the conclusion that the purchase makes sense. In others, we realize it would not be profitable for that operation.

Are you now wondering how you can get started evaluating a potential machinery purchase? Our free Ag Breakeven Calculator can help you quickly and accurately calculate your breakeven point for an individual field or for your overall crop.

If you have any questions, or if you would like to schedule a one-on-one meeting with one of our relationship managers to go over the breakeven point of your full operation, feel free to email me at janderson@mybhank.com or call me at 402-463-0101.

Heartland Bank is a family-owned bank located in 13 different communities across the heart of Nebraska. Heartland Bank's vision is to improve the lives of customers, associates, and communities. Voted American Banker 2022 Best Banks to Work For. Learn more at MyHeartland.Bank.